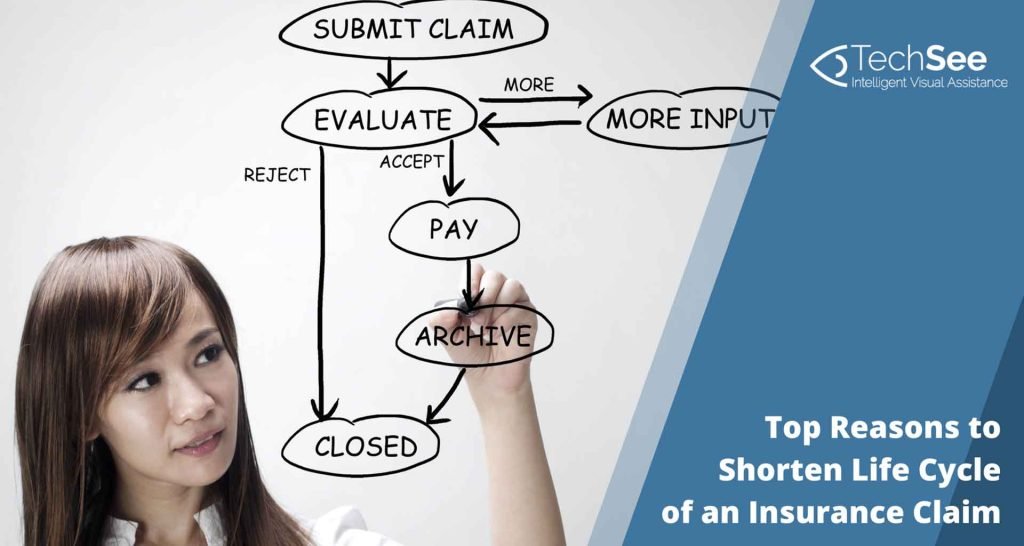

The lifecycle of an insurance claim refers to the various stages involved in processing and resolving an insurance claim. Here is a general outline of the typical lifecycle of an insurance claim:

1. Reporting the Claim: The policyholder or the insured party notifies the insurance company about the incident or loss that may be covered by the insurance policy. This can be done through various channels, such as phone, email, or online portals.

2. Claim Assignment: Once the claim is reported, the insurance company assigns a claim adjuster or claims handler to the case. The adjuster is responsible for investigating the claim and determining its validity.

3. Claim Investigation: The claims adjuster conducts a thorough investigation to gather all relevant information about the claim. This may involve collecting documents, interviewing witnesses, examining the damaged property, or reviewing medical records, depending on the nature of the claim.

4. Claim Evaluation: Based on the findings of the investigation, the claims adjuster evaluates the claim to determine whether it is covered under the insurance policy. They assess the extent of the damages or losses and compare them to the policy terms and conditions.

5. Claim Settlement: If the claim is deemed valid and covered by the policy, the insurance company will offer a settlement amount to the policyholder. This settlement may be a reimbursement for the actual cash value of the loss or the replacement cost, depending on the policy terms.

6. Negotiation (if applicable): In some cases, the policyholder and the insurance company may engage in negotiations to reach a mutually agreed-upon settlement amount. This can involve discussions, presentations of additional evidence, or the involvement of a mediator.

7. Claim Payment: Once the settlement is agreed upon, the insurance company issues a payment to the policyholder. The payment can be made via check, direct deposit, or other agreed-upon methods.

8. Claim Closure: After the payment is made, the insurance claim is considered closed. The policyholder acknowledges the receipt of the settlement, and any further claims related to the same incident are generally not accepted.

It’s important to note that the duration of each stage can vary depending on the complexity of the claim, the availability of information, and the responsiveness of the involved parties. Additionally, different types of insurance claims, such as auto insurance, property insurance, or health insurance, may have specific variations in their claim lifecycle.